Welcome to the realm of Canadian wage wizardry! Understanding your paycheck can feel like deciphering an arcane language, but fear not. In this guide, we’ll demystify the complexities of Canadian payroll, empowering you to decode your earnings with confidence. From deductions to benefits, we’ll uncover the secrets behind your paycheck, equipping you with invaluable knowledge for financial empowerment.

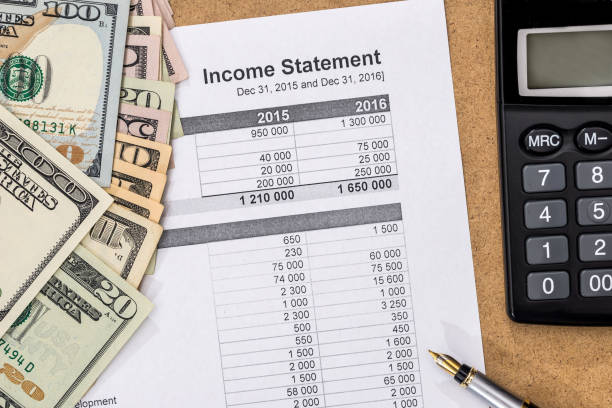

Decoding Your Gross Income

Your journey into paycheck enlightenment begins with understanding your gross income. This figure represents your total earnings before any deductions are applied. For salaried employees, this amount remains consistent from paycheck to paycheck, providing a reliable foundation for budgeting and financial planning. However, for hourly workers, gross income fluctuates based on hours worked, making it essential to track your time accurately.

Navigating Deductions

Ah, deductions – the enigmatic realm of payroll that often leaves employees scratching their heads. In Canada, various deductions may be withheld from your paycheck, including income tax, Canada Pension Plan (CPP) contributions, and Employment Insurance (EI) premiums. Understanding the purpose and calculation of these deductions is crucial for optimizing your financial situation.

Unveiling Income Tax

Income tax is perhaps the most significant deduction on your paycheck, directly impacting your take-home pay. The amount of income tax withheld depends on your income level and tax bracket, as determined by the Canadian tax system. By familiarizing yourself with tax brackets and credits, you can strategically minimize your tax burden and maximize your net income.

Navigating CPP Contributions

The Canada Pension Plan (CPP) is a mandatory contribution designed to provide Canadians with retirement income. Both employees and employers contribute to the CPP, with contributions based on a percentage of earnings up to a maximum annual limit. Understanding your CPP contributions is essential for planning your retirement and ensuring financial security in your golden years.

Understanding Employment Insurance (EI)

Employment Insurance (EI) provides temporary financial assistance to individuals who are unemployed or unable to work due to illness, maternity leave, or other qualifying reasons. EI premiums are deducted from your paycheck, with the amount based on your earnings and the applicable premium rate. Familiarizing yourself with EI benefits and eligibility criteria can help you navigate unexpected financial challenges with confidence.

Maximizing Your Net Income

Armed with knowledge of deductions and contributions, you’re now ready to unlock the secrets of maximizing your net income. By strategically managing your finances, leveraging tax-saving opportunities, and exploring employer benefits such as retirement plans and health insurance, you can optimize your take-home pay and achieve greater financial stability.

Leveraging Payroll Tools and Resources

In the digital age, a wealth of payroll tools and resources are available to empower Canadian employees in managing their finances. From online paycheck calculators to government resources outlining tax policies and entitlements, leveraging these tools can enhance your financial literacy and facilitate informed decision-making.

Cultivating Financial Wellness

Beyond understanding your paycheck, cultivating financial wellness is an ongoing journey towards fiscal health and resilience. By budgeting wisely, saving diligently, and investing strategically, you can build a secure financial future for yourself and your loved ones. Remember, financial empowerment begins with education and action.

Conclusion:

Congratulations! You’ve journeyed through the labyrinth of Canadian paycheck estimation and emerged victorious. Armed with newfound knowledge and insights, you’re now equipped to navigate the intricacies of payroll with confidence and clarity. Remember, your paycheck is more than just numbers – it’s a reflection of your hard work and dedication. By mastering the art of wage wizardry, you can harness the power of your earnings to achieve your financial goals and dreams.